Budget 2021 Malaysia Tax Relief | Malaysia Budget 2021 Highlights Mypf My

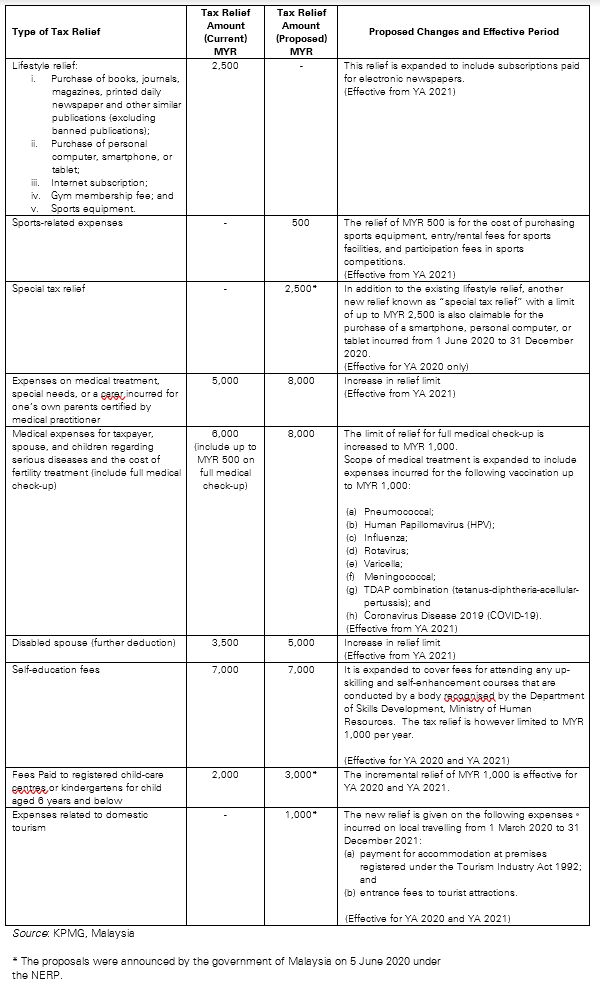

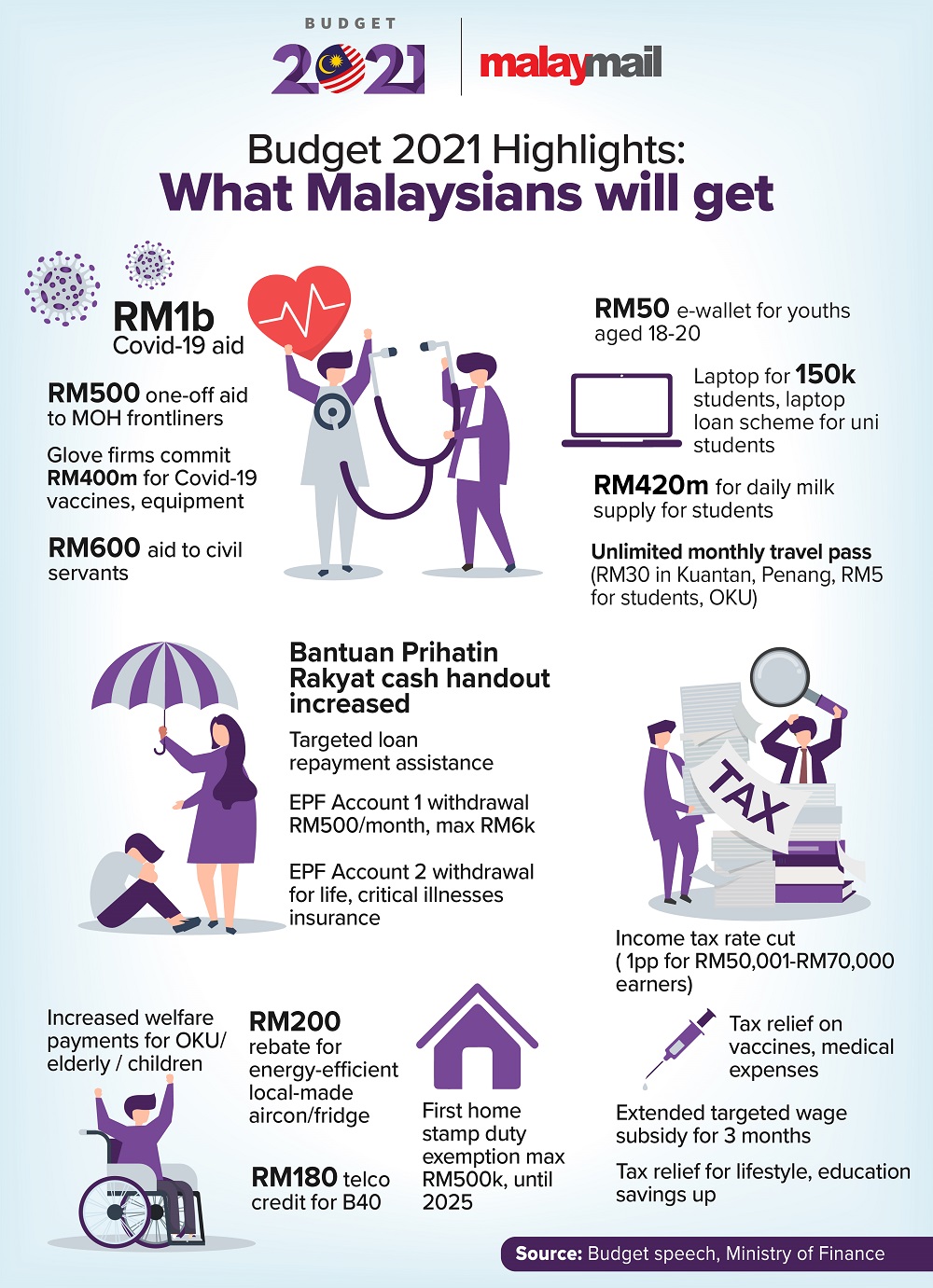

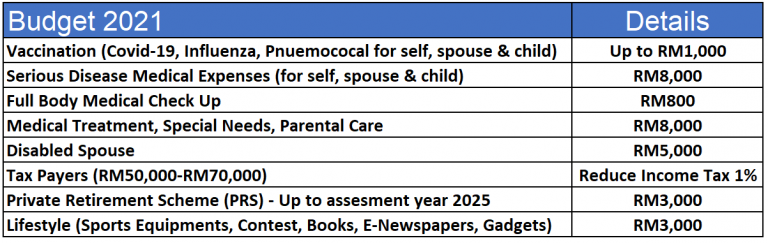

In Budget 2021 the scope of the tax relief was expanded to include expenses on certain vaccinations including COVID-19 for self spouse and child. KUALA LUMPUR Oct 29 Finance Minister Tengku Zafrul Aziz today announced.

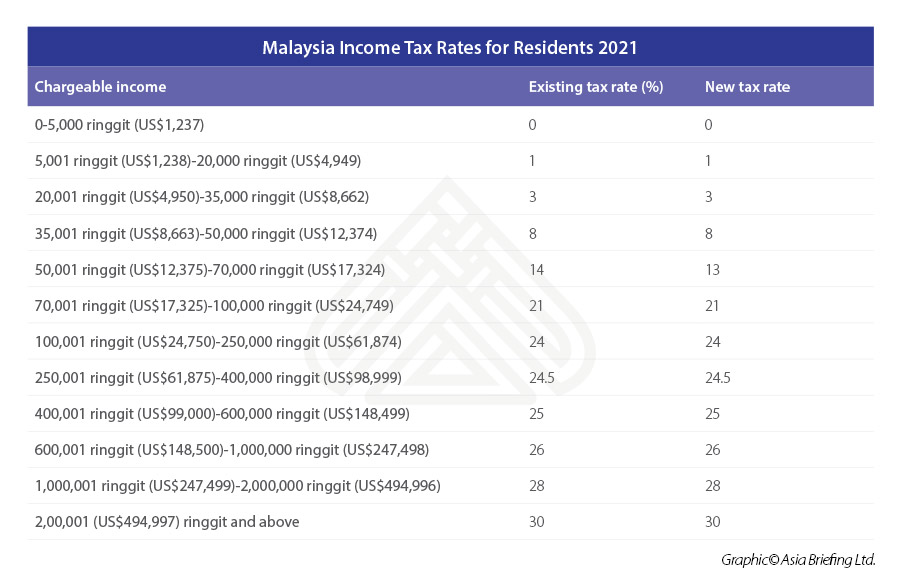

Reduction of individual income tax rate.

Budget 2021 malaysia tax relief. Although the tax saved is only RM200 it does help when households are grappling with the economic fallout from. The income tax rates 2021 exemption limit for compensation for loss of employment will be increased from RM10000 to RM20000 for each full year of service. From year of assessment 2021.

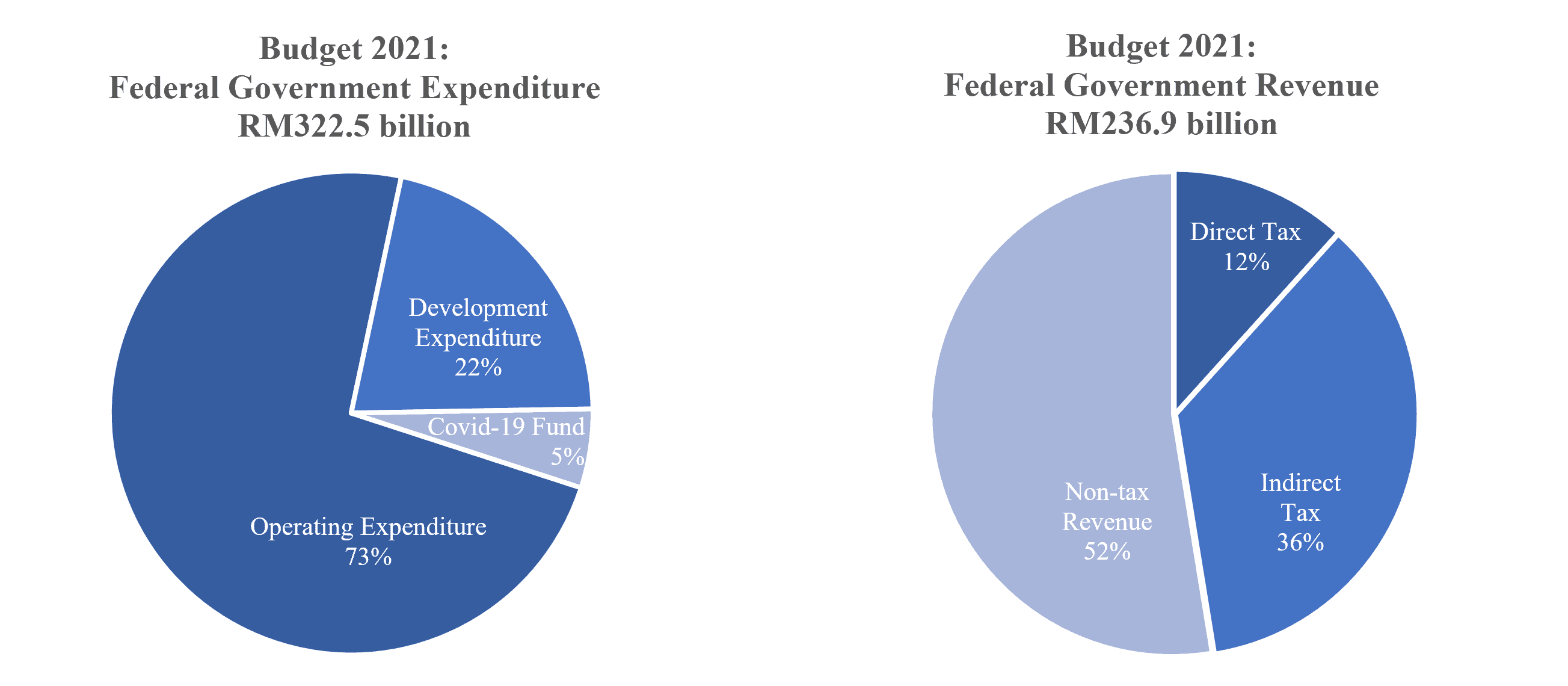

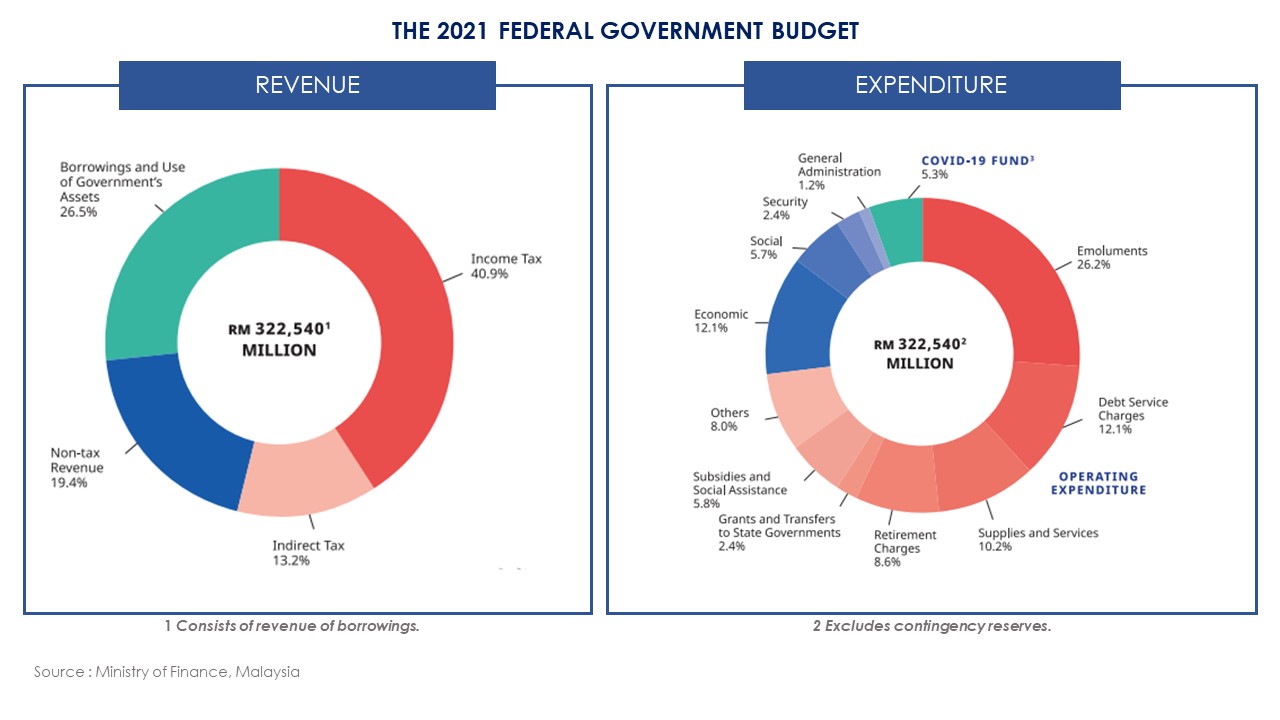

The tax highlights of Budget 2021 include. The limit of tax relief on expenses for medical treatment special needs and parental care will be increased from RM5000 to RM8000. Budget 2021 is the largest budget in Malaysias history with a total of RM3225 billion compared to RM297 billion for Budget 2020.

The tax relief on expenses for medical treatment special needs and parental care will also be raised from RM5000 to RM8000 he said during the tabling of the Budget 2021 in parliament on. From year of assessment 2021. To encourage saving for retirement the RM3000 tax relief on Private Retirement Scheme PRS contributions has been extended until YA 2025 said.

Nobody could have expected the severe economic impact that the Covid-19 pandemic has had on many nations including Malaysia. Reduction in personal income tax rate by one percentage point for tax resident individuals for chargeable income in the band of RM50001 to RM70000 Preferential 15 personal tax rate for non-Malaysian citizens holding key positions in. 2 2021 Malaysia Budget Highlights EXECUTIVE SUMMARY Dear Friends What a difference a year makes.

Natálie Šteyerová Pixabay. AIS are to be introduced into the Income Tax Act 1967 ITA 1967. Fri 29 Oct 2021 851 PM KUALA LUMPUR Oct 29.

The recovery of businesses is a top priority for the government under Budget 2022 with a host of incentives and assistance schemes to be offered to businesses especially small-and-medium enterprises SMEs. Income tax rate for resident individuals to be reduced from 14 to 13 for the chargeable income band of RM50001 to RM70000 from Year of Assessment YA 2021. Non-resident individuals tax rate remains at a flat rate of 30.

Savemalaysia Publish date. There is also an increase an extension and an expansion of the scope of tax reliefs. Income tax rate for.

This time last year the Malaysian economy was forecasted to remain resilient despite external headwinds with GDP expected to grow at a slightly faster pace of 48 in 2020. Income Tax Reliefs For Psychotherapy Counselling By CodeBlue Posted on 29 October 2021 29 October 2021. It is proposed that the resident individual tax rate be reduced by 1 from 14 to 13 for the chargeable income band RM50001 to RM70000.

There should also be a higher special personal tax relief of RM3500 for Covid-19 health prevention-related expenses and a higher tax relief limit for contributions to the Employees Provident. He also announced a 100 road tax exemption for EVs. Increase of tax relief for parents medical expenses.

The main objective is to help taxpayers who have lost their jobs due to the current pandemic. The minister said to promote the development of the local EV industry the government proposes to provide full tax exemption for import duty excise duty and sales tax for electric vehicles. The government has allocated RM70 million to address mental health issues exacerbated by the Covid-19 pandemic.

TaXavvy Budget 2021 Edition - Part 1 8. This would help reduce the. Review of Income Tax Rate Limited to 5 non- Malaysian citizens employed in key positions C -suites.

Increase of tax relief for parents medical expenses. This will help reduce the financial. The governments announcement on expanding the scope for tax relief limit for medical treatment for serious illnesses would be increased from RM6000 to RM8000 for the individual taxpayer spouse and child has eased many rakyats burden especially in the face of the current situation.

This was announced by Finance Minister Tengku Zafrul during the tabling of Budget 2022. The tax rate will be reduced from 14 to 13 for the year of assessment 2021. AIS is defined to include.

Any high technology activity in manufacturing and services sector. For investment made from 1 January 2021 to 31 December 2023 Tax Incentives Budget commentary Budget 2021 has taken bold measures to place Malaysia as the forefront destination for regional and high value-added services with the introduction of 10 years tax exemption incentive. The limit of tax relief on expenses for medical treatment special needs and parental care would be increased from MYR 5000 to MYR 8000.

The incentives aids and tax reliefs to spur business recovery under Budget 2022 Author. The scope of the medical check-up relief of RM1000 is expanded to include COVID-19 screening tests. FOR the middle-income M40 group one piece of good news from Budget 2021 could be the reduction in tax rate by one percentage point for the chargeable income band of RM50001 to RM70000.

Budget 2021 - Tax relief on medical treatment for serious illness Share. TaXavvy Budget 2021 Edition - Part 2 7 Tax incentives Tax treatments for Approved Incentive Schemes AIS Provisions for Incentive Schemes approved by the Minister of Finance ie. Special tax relief for purchase of handphones computers or tablets.

4 December 2020. Malaysia presented the 2021 Budget proposals announcing a slight reduction in the individual income tax rate by 1 percent for resident individuals at the chargeable income band of MYR 50001 to MYR 70000.

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

Budget 2021 Highlights Here S What Malaysians Can Expect Get Directly Tax Breaks Handouts Subsidies And More

Individual Income Tax Amendments In Malaysia For 2021

Ttcs Insights To Budget 2021 Thannees

Budget 2021 Payroll Hr Highlights Centralhr Fully Integrated Hr Solutions

Key Takeaways Of Malaysia Budget 2021

Budget 2021 Here Are The Key Highlights And Takeaways For You

Permai Assistance Package 2021 Crowe Malaysia Plt

How Can Budget 2021 Benefit Malaysian Black Belt Millionaire

My Tax Measures Affecting Individuals In Budget 2021 Kpmg Global

Malaysia Budget 2021 Vital To Boost Investment Sentiment Asean Economic Community Strategy Center

Highlights Of Budget 2021 Cheng Co

Malaysia Budget 2021 Highlights Mypf My

Budget 2021 Here Are The Key Highlights And Takeaways For You

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2021 Homage Malaysia

Budget 2021 Here Are The Key Highlights And Takeaways For You